US Bank bankruptcy crisis gets worse as customer lawsuits pile up

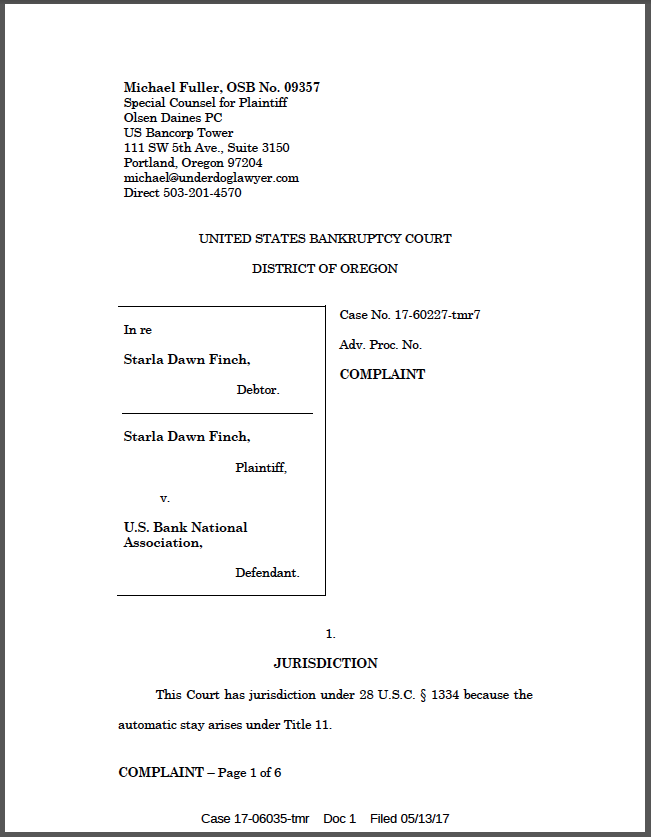

Today we filed suit against US Bank in Oregon bankruptcy court. This is our second complaint in two months against the bank for violating the bankruptcy rules. Last month the bank was slapped with a $15 million fine for bankruptcy violations.

Listen to our client’s recording of this illegal collection call during bankruptcy:

US Bank Harasses Borrowers During Bankruptcy

Our client says the bank threatened and harassed her after it learned she filed bankruptcy. In March we filed a similar lawsuit against the bank for a Portland man alleging similar misconduct.

The automatic stay protects bank customers from collector harassment during bankruptcy. But not all banks follow the rules.

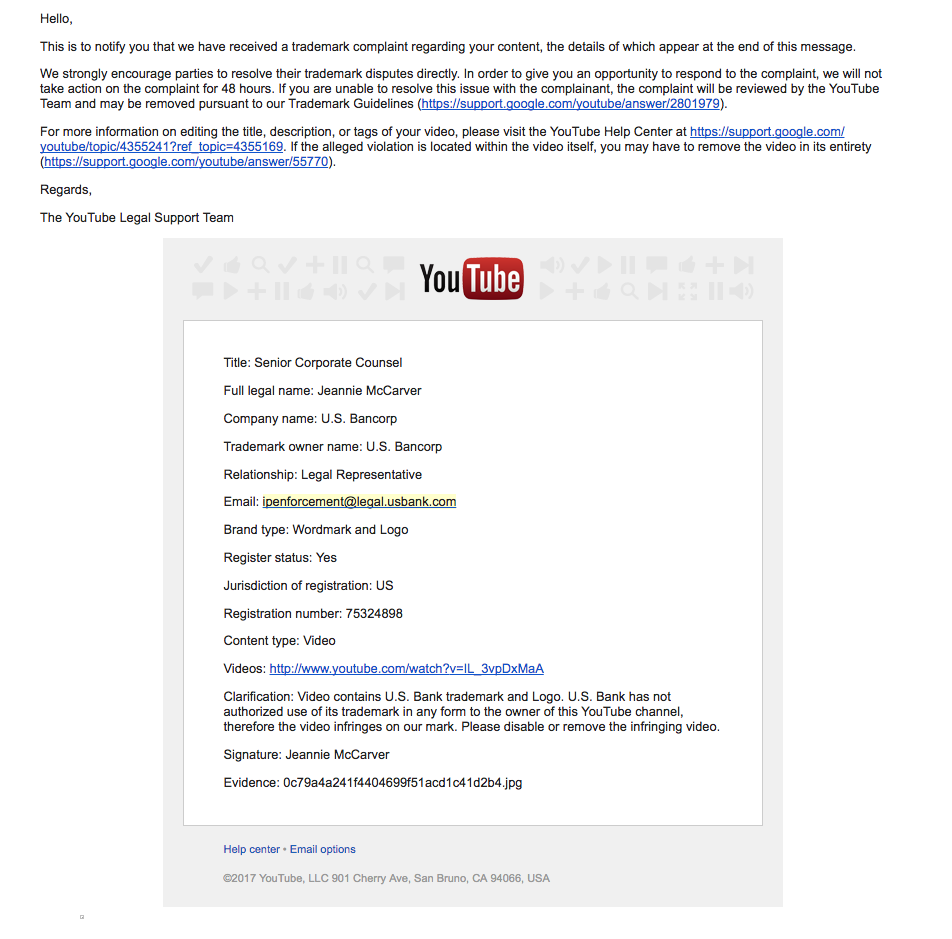

Rather than do the right thing, US Bank tried to remove our call recording from YouTube. The takedown notice we received is below:

As of the date of this post, our video of the call recording remains online.

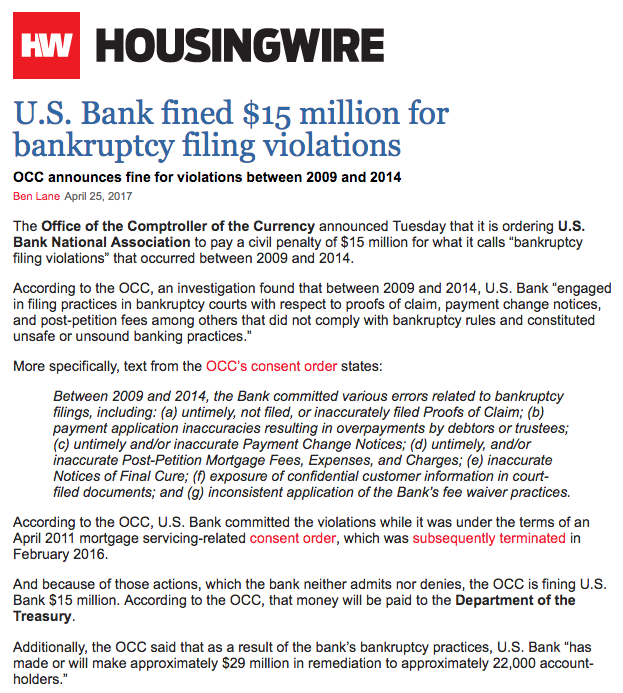

US Bank Fined $15 Million for Bankruptcy Violations

US Bank is no stranger to bankruptcy violations. Last month, Housing Wire announced the bank had systematically failed to comply with the bankruptcy rules in cases across the country.

Click to read the Housing Wire article

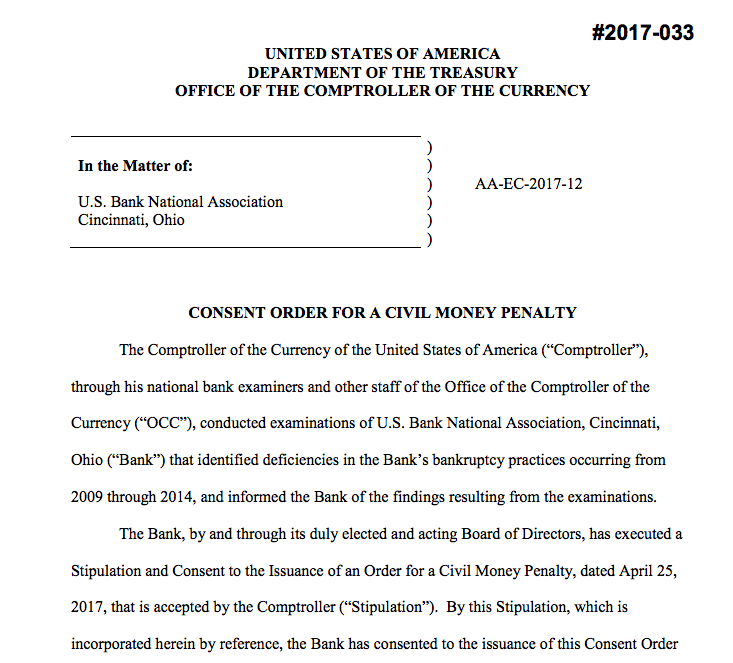

The bank was fined $15 million for systematic bankruptcy violations occurring from 2009 to 2014.

Click to read the $15 million penalty order

Both of our lawsuits ask the Oregon bankruptcy court for fair compensation and punitive damages. In 2014, the bank was sanctioned for similar collection misconduct by New York Bankruptcy Judge Louis Scarcella.

Here’s a copy of the complaint we filed today:

Click here to read our complaint

Bank statements show the bank seized money from our client after it learned she filed bankruptcy. Our complaint says the bank wrongfully threatened to harm our client’s credit if she did not pay its debt during bankruptcy. Our client says she complained to the bank in person several times and it continues to refuse to do the right thing.