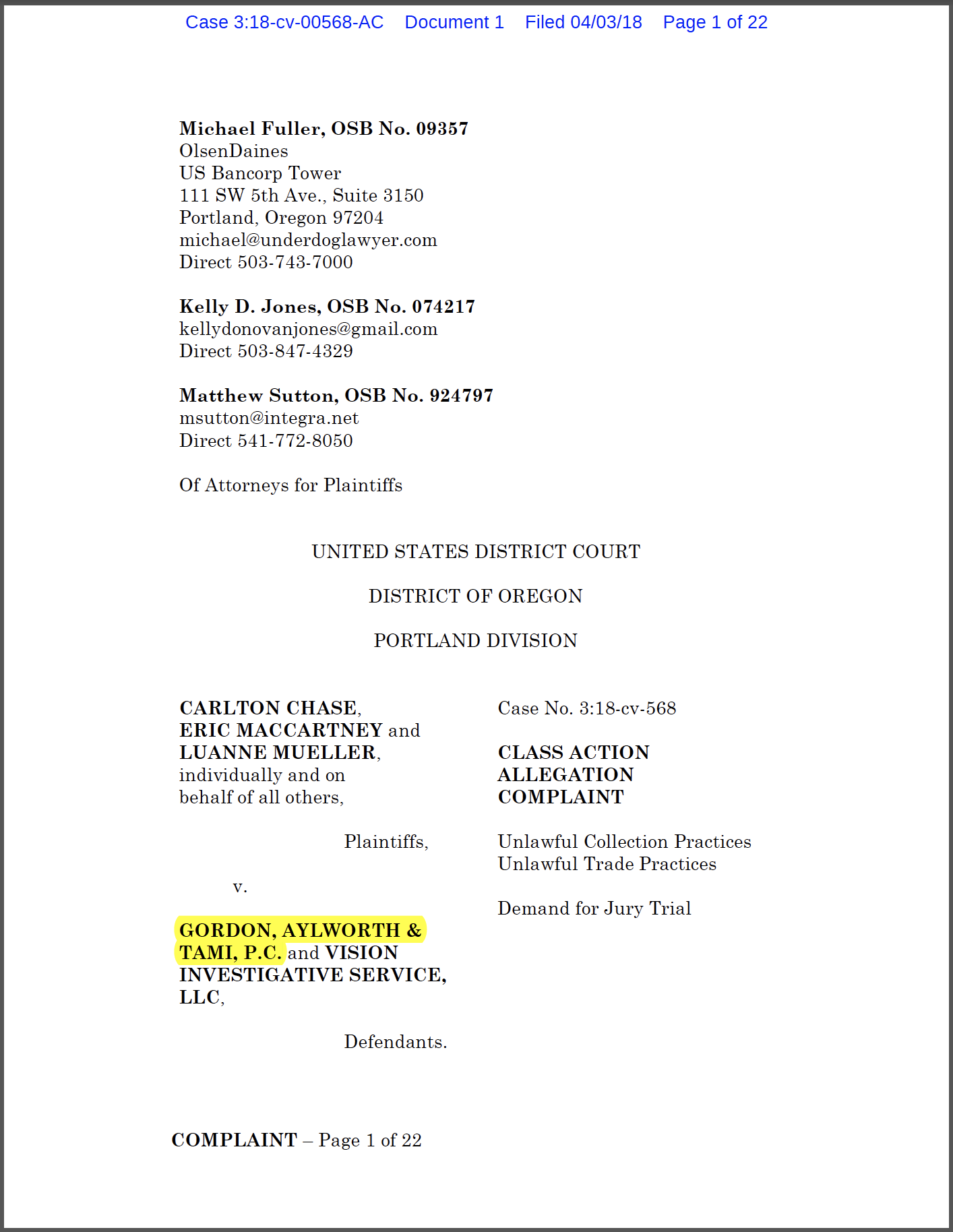

Oregon Debt Collector Class Action

Submit a claim if you were sued by Oregon debt collector Gordon Aylworth & Tami:

Laws protecting people from unfair debt collection date back to America’s Founding Fathers. The Constitution instructed Congress to enact uniform laws on debt forgiveness. Almost 75 years after the Constitution was ratified, Congress passed the 13th Amendment, prohibiting all forms of indentured servitude. Another 100 years later, the United States Supreme Court began declaring debtors’ prisons unconstitutional. In 1977, Congress passed the Fair Debt Collection Practices Act to protect people from unfair collection practices. Oregon law specifically prohibits collectors from charging excessive service fees.

But not all collectors choose to follow the law.

On May 4, 2017, the Eugene, Oregon debt collection law firm of Gordon, Aylworth & Tami, P.C. (GAT) filed a lawsuit against Mr. Carlton Chase. GAT filed its lawsuit to collect a credit account debt Mr. Chase had become unable to pay. In addition to the credit account debt amount of $752.64, GAT added a $45 fee by falsely claiming “expedited service”. Routine service would not have exceeded a cost of $36. GAT subsequently collected the debt and “expedited service” fee from Mr. Chase in full.

Unknown to Mr. Chase at the time, Oregon law prohibited GAT from collecting a routine service fee in excess of $36. Higher costs were only permissible if they were both reasonable and necessary. GAT’s $45 fee was not reasonable when the actual cost of service by mail was approximately $7. Upon investigation, Mr. Chase discovered that he wasn’t alone. To increase profits, GAT regularly charges unreasonable and unnecessary and excessive service fees, in violation of Oregon and federal law. Similar to Mr. Chase, Mr. Eric MacCartney and Ms. Luanne Mueller were also charged excessive service fees by GAT in 2017.

Plaintiffs discovered that GAT funneled the excessive service fees through a dummy service company that was controlled and operated by attorneys for GAT. By charging excessive service fees and funneling the profits through a dummy service company, GAT puts local debt collectors that do not overcharge consumers at a competitive disadvantage. Although the excessive service fees of at least $9 may not have caused substantial damage to each plaintiff individually, the aggregate damages suffered by similarly situated consumers are indeed substantial.

To paraphrase Judge Posner, “only a lunatic or a fanatic” goes to court over a $9 excessive service fee. So, plaintiffs file this lawsuit as a class action, on behalf of themselves, and thousands of other consumers ripped off by GAT’s unlawful collection practices.

Plaintiffs file this case in hopes of stopping GAT from continuing to demand and collect excessive service fees in its lawsuits. They also hope to force defendants to return the thousands of dollars in excessive service fees that they have unlawfully collected from unwitting Oregon consumers.