US Bank bankruptcy crisis gets worse as customer lawsuits pile up

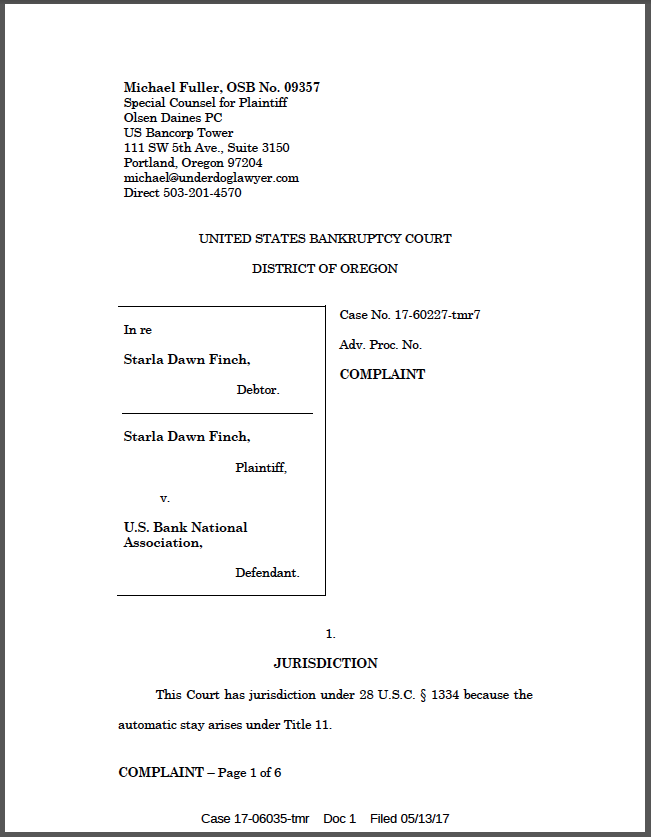

Today we filed suit against US Bank in Oregon bankruptcy court. This is our second complaint in two months against the bank for violating the bankruptcy rules. Last month the bank was slapped with a $15 million fine for bankruptcy violations.

Listen to our client’s recording of this illegal collection call during bankruptcy:

US Bank Harasses Borrowers During Bankruptcy

Our client says the bank threatened and harassed her after it learned she filed bankruptcy. In March we filed a similar lawsuit against the bank for a Portland man alleging similar misconduct.

The automatic stay protects bank customers from collector harassment during bankruptcy. But not all banks follow the rules.

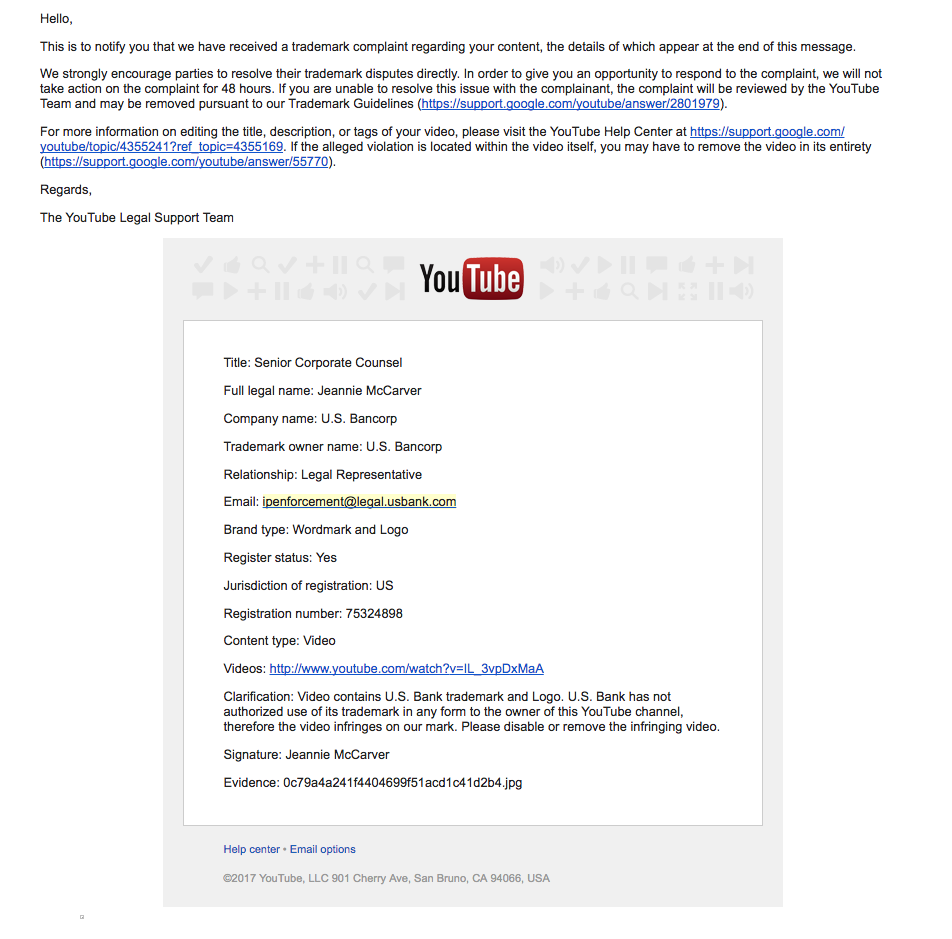

Rather than do the right thing, US Bank tried to remove our call recording from YouTube. The takedown notice we received is below:

As of the date of this post, our video of the call recording remains online.

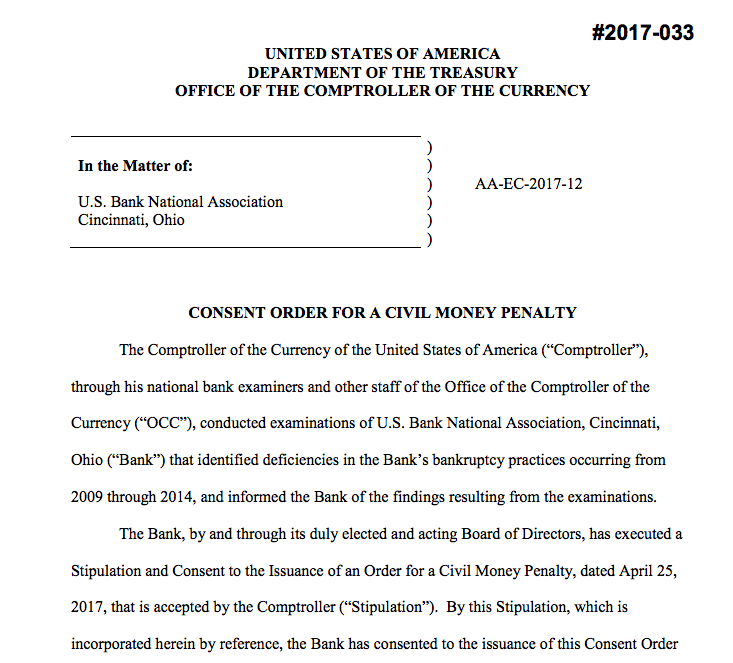

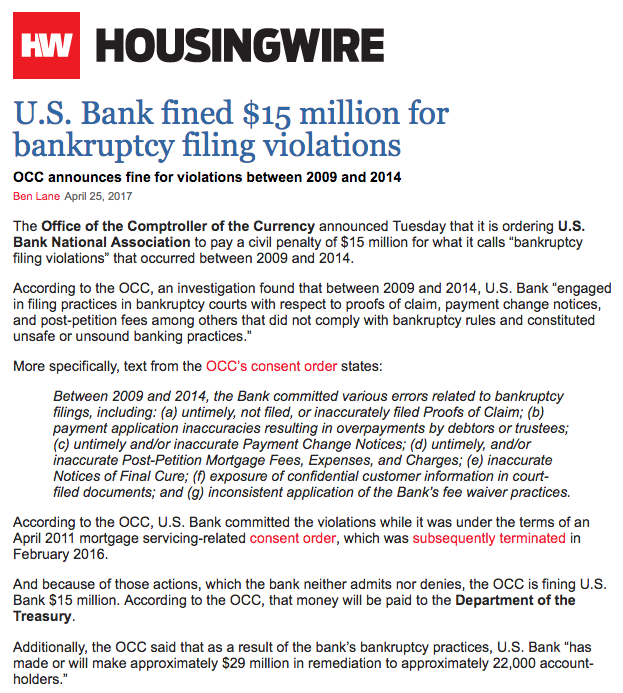

US Bank Fined $15 Million for Bankruptcy Violations

US Bank is no stranger to bankruptcy violations. Last month, Housing Wire announced the bank had systematically failed to comply with the bankruptcy rules in cases across the country.

Click to read the Housing Wire article

The bank was fined $15 million for systematic bankruptcy violations occurring from 2009 to 2014.

Click to read the $15 million penalty order

Both of our lawsuits ask the Oregon bankruptcy court for fair compensation and punitive damages. In 2014, the bank was sanctioned for similar collection misconduct by New York Bankruptcy Judge Louis Scarcella.

Here’s a copy of the complaint we filed today:

Click here to read our complaint

Bank statements show the bank seized money from our client after it learned she filed bankruptcy. Our complaint says the bank wrongfully threatened to harm our client’s credit if she did not pay its debt during bankruptcy. Our client says she complained to the bank in person several times and it continues to refuse to do the right thing.

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Reddit (Opens in new window) Reddit

- Click to email a link to a friend (Opens in new window) Email

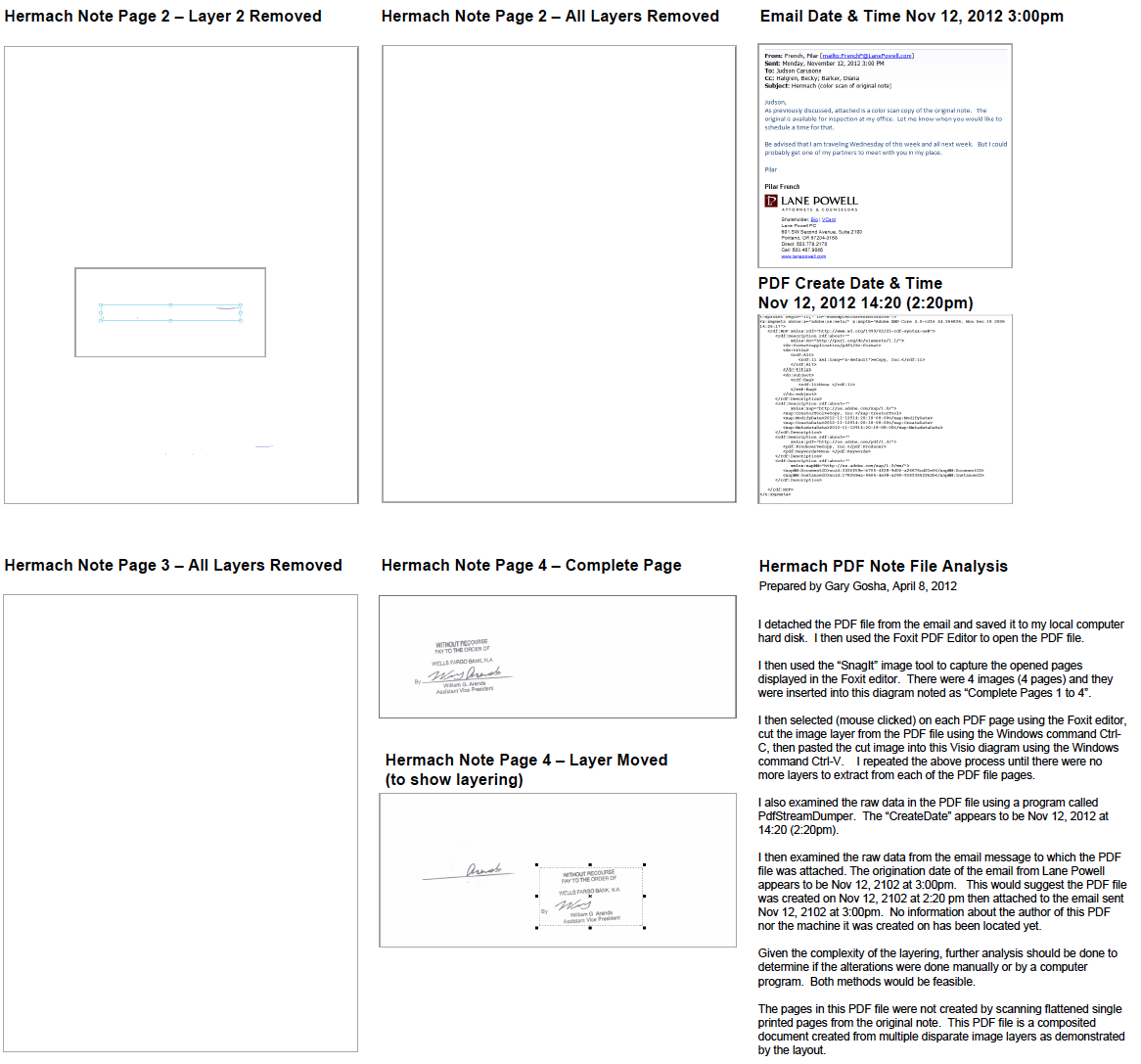

New Wells Fargo forgery scandal raises familiar questions

A newly uncovered Wells Fargo email suggests the bank fabricated an Oregon mortgage note.

Wells Fargo Forgery Exposed

Click to view full forgery image

This newly discovered forgery raises familiar questions about the bank’s mortgage practices.

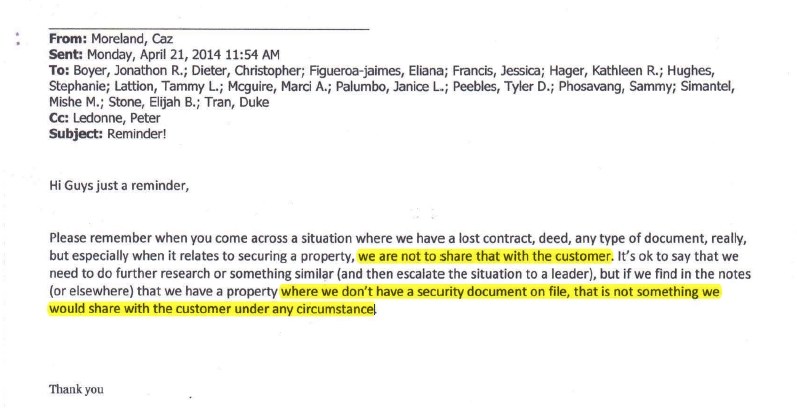

Wells Fargo’s Internal Email About Missing Documents

In a 2015 Oregon whistleblower lawsuit, a former employee claimed the bank told him to lie to customers about missing mortgage documents.

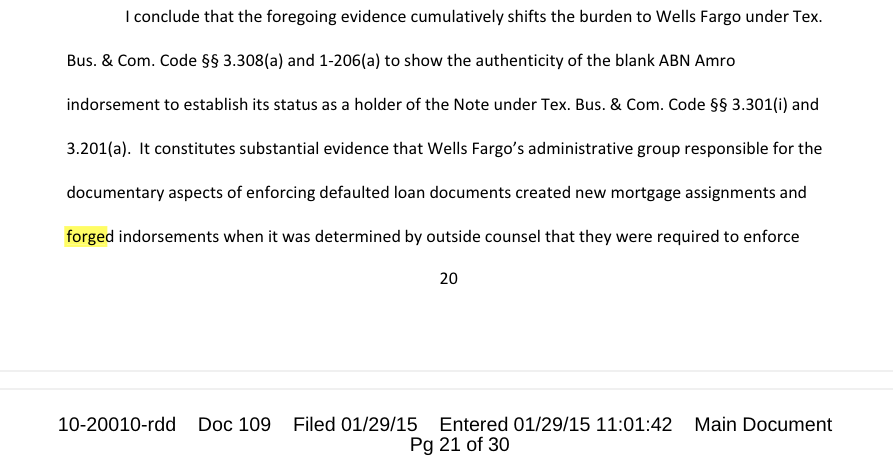

Texas Judge Examines Forgery Practices

Click to read the judge’s entire opinion

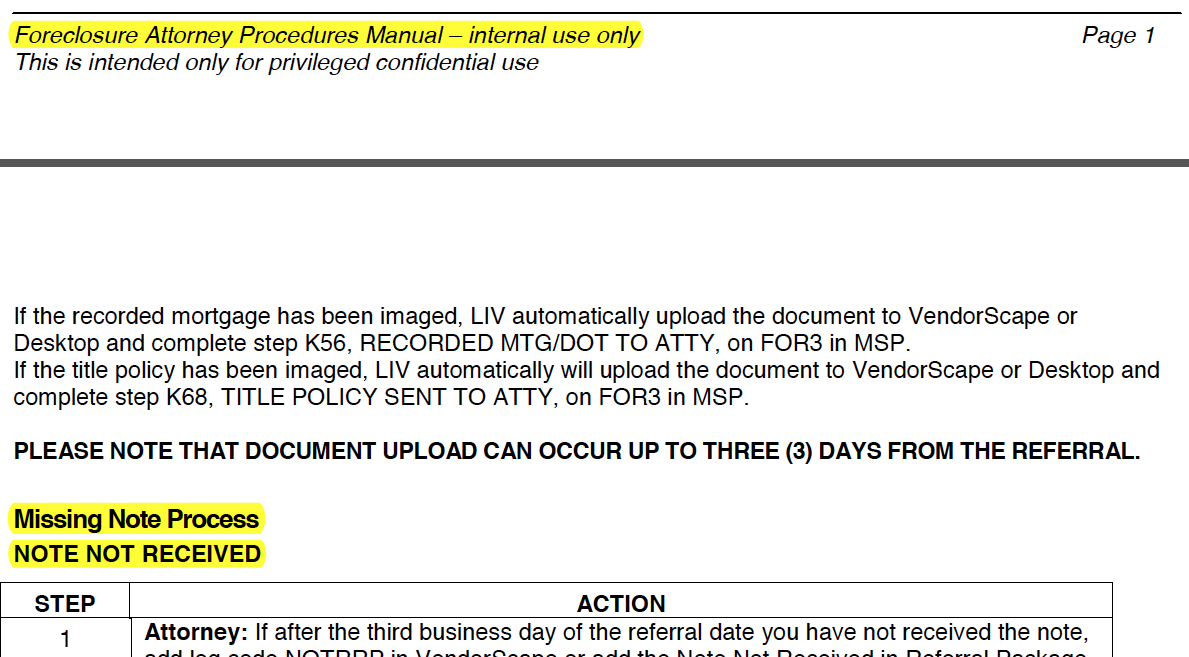

Wells Fargo’s Internal Forgery Manual

This new Oregon forgery case is unique because the homeowner seemingly caught the bank red-handed. The so-called “original note” turned out to contain 4 separate image layers. The note text and signature layers were allegedly fabricated to foreclose on a Lane County home in 2013. The bank has been hit with various scandals involving dishonesty in recent months. See related articles:

5,300 Wells Fargo employees fired over 2 million phony accounts

CNN

Senators Investigate Reports Bank Punished Workers

NPR

Bank Tells Employees to Lie to Customers

Reuters

This Oregon forgery is not the first time the bank has been accused of fabricating documents. A 2014 lawsuit claimed the bank fired an employee for refusing to lie to customers. Click here to read more about the 1.4 billion whistleblower lawsuit.

In 2015, New York bankruptcy judge Robert Drain described the bank’s forgery process in detail. Read the judge’s memorandum. The 30 page court opinion ultimately granted a homeowner’s objection to the bank’s proof of mortgage claim. Click here to read the bank’s internal manual. The manual seemingly tells the bank’s legal team how to forge missing foreclosure documents.

See related articles:

NY Judge Slams Bank For Forging Documents…

Zero Hedge

Family Gets $5M For Robosigned Foreclosure Docs

Foreclosure Defense and Loan Modification Blog

For more information email michael@underdoglawyer.com.

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Reddit (Opens in new window) Reddit

- Click to email a link to a friend (Opens in new window) Email

Oregon mortgage lawsuit: Portland homeowner wins round one

An Oregon mortgage lawsuit largely survived a motion to dismiss, based on a recent ruling by judge Anna Brown.

The Oregon mortgage lawsuit claims that loan servicer Madison Management Services failed to respond to various requests for information sent by Portland consumer Anna Nguyen.

Read the complaint and full court opinion.

Oregon Mortgage Lawsuit under the RESPA

Federal law requires mortgage companies to respond to requests for information and notices of servicing errors. The Real Estate Settlement Procedures Act requires mortgage servicers to acknowledge receipt of consumer requests within 5 days, and respond within certain time frames.

In Nguyen’s case, Oregon federal judge Anna Brown decided that new regulations passed after the subprime mortgage crisis give borrowers the right to sue mortgage companies for failing to comply.

Judge Brown also allowed Nguyen to sue Madison Management Services for failing to comply with the Truth in Lending Act. Nguyen’s TILA claims are based on the mortgage company’s failure to send her mortgage statements and interest disclosures. Regulation Z requires servicers of adjustable-rate mortgages “to provide borrowers with disclosures in connection with the adjustment of interest rates–.”

Oregon Mortgage Lawsuit under the FDCPA

Nguyen’s claim under the Fair Debt Collection Practices Act also survived dismissal. Her FDCPA claim is based on the mortgage company’s failure to take certain actions required under federal law. The FDCPA prohibits any conduct that would harass, oppress, or abuse any person in connection with the collection of a debt.

Nguyen’s claims under the Oregon UTPA were dismissed because her loan was obtained before 2010. The court is expected to set the case for a rule 16 conference in the coming weeks.

—

Michael Fuller is a partner at Olsen Daines and an adjunct professor of consumer law at Lewis & Clark Law School in Portland, Oregon.

Share this:

- Click to share on Facebook (Opens in new window) Facebook

- Click to share on X (Opens in new window) X

- Click to share on LinkedIn (Opens in new window) LinkedIn

- Click to share on Pinterest (Opens in new window) Pinterest

- Click to share on Tumblr (Opens in new window) Tumblr

- Click to share on Reddit (Opens in new window) Reddit

- Click to email a link to a friend (Opens in new window) Email

Class Action Inquiry

My Practice Areas

Underdog Law Office

Sample Letters

Client Reviews*

Did you hear we won in court yesterday?! Mike Fuller was GREAT! I’m still in shock!

Just a further note to thank you for undertaking this matter, not just pro bono but on less than 24 hours’ notice. You did one incredible job. Whatever you did—I’m still not clear— Tremendous result.

We’re still in awe over winning in court. I’m not sure how to show our appreciation, but you were totally AWESOME!!

This apology actually made me feel better than I thought it would! I truly appreciated all you did on this endeavor. Thank you and more.

I heard that you are a man to be feared in a court of law, who is a genius at getting the truth out of someone. Sorry I was not there but you have my thanks.

Michael became my ‘architect’, a skillful legal mind with a clear understanding of complex bankruptcy litigation, and I did not become a ‘victim’, WE WON! Thank you Michael!

I just received the refund check from Wells Fargo for my visa. Congrats sir, you forced them to bend to your will lol. Thank you SO much, this is a huge help.

Thank you so much! We are literally blown away at the timely result of this case. You really do know your stuff! Great working with you!

Your humanity has inspired me to continue paying forward and to assist others wherever I can when called upon. Warm regards,

Success at last! That the last letter we sent to Equifax, TransUnion and Experian really made a difference. Thanks for seeing this through to a successful conclusion.

Thank you, thank you, thank you! Thank you for providing the document and working so late in the night to get it to us.

Thank you all for everything today. We like lawyers that are as tenacious and spunky as we are, and not afraid to fight when needed, good job today.

Michael will not back down even when dealing with huge corporate packs of attorneys. He is the guy you want in your corner.

Michael Fuller is the best. A true advocate for the little guy against corporate America! I can’t thank him enough.

Michael gave us the courage to sue our mortgage company and secured a six figure settlement. Don’t be bullied — hire an attorney to stop illegal collections.

It seems unheard of to have anyone be so generous without asking for compensation. I can’t say enough about the character you’ve shown. Blessings from all of us who believe in what is right.

When [Mr. Fuller] is on the job, I’m not too concerned that [his] opponents are going to be able to get away with much.

Mr. Fuller you are amazing. A super hero. I can not believe how fast you work. Thank you so much.

Lewis & Clark Law School Students

Sample Lawsuits

American Express

Bank of America

Chase Bank

CitiBank

Discover Bank

MetLife

OneMain Financial

US Bank

Wells Fargo

Web Bank

Corporate America

Comcast

Paypal

Starbucks

Tan Republic

Swisher Sweets

Sirius XM

Rodale Inc.

NW Natural

Mt Hood Meadows

Kroger

BMW

Austin's Auto

AT&T

GameStop

Fred Meyer

Target

Toyota

LA Fitness

Macys

Fingerhut

Aaron's Leasing

ADP

Student Loans

Sallie Mae

PSU

PHEAA

Navient

FedLoan Servicing

AES

Discover Loans

Dept. of Education

ECMC

NCT

Mortgage Companies

21st Mortgage

SLS

Ditech Mortgage

Nationstar Mortgage

Mr. Cooper Mortgage

Ocwen Mortgage

PennyMac Mortgage

Fannie Mae

Seterus Mortgage

Green Tree Mortgage

Credit Reports

Equifax

Experian

Trans Union

Debt Collectors

Northland Group

Columbia Collection

Metro Area Collection

Cach LLC

GS Services

Credit Associates

Western Mercantile

S. Oregon Credit

Ray Klein

Rapid Cash

Quick Collect

Portland Credit

PCS

General Credit

EOS CCA

EGP Investments

Credit International

Credit Bureau

Collecto

Carter Jones

Asset Systems

Ad Astra