Oregon Student Loan Lawyer Michael Fuller

I’m an Oregon student loan lawyer. I wipe out student loans. I defend student loan lawsuits and stop collection calls.

It takes guts to borrow student loans. I know – I was the first in my family to go to college.

Audio: Our Judge calls student debt ‘pretty unfair’

On September 8, 2016, we took a university to trial in Oregon bankruptcy court. We won. The university had to refund our client’s money and give him his transcripts. The judge ruled that our client’s unpaid tuition debt was wiped out in bankruptcy.

My Nonprofit Oregon

Student Debt Project

In 2015 I started a nonprofit project called Oregon Student Debt. So far we’ve wiped out over $700,000 student loans for low income borrowers.

Both federal and private student loans can be wiped out in Oregon bankruptcy court. Call legal aid at 503-224-4086 to apply. Call me directly at 503-201-4570 with questions.

Our pro bono project is completely free as a public service. Take this 60-second quiz to see if you qualify for bankruptcy forgiveness:

Undue Hardship Student Loan Michael Fuller 503-201-4570

Click here to download the Quiz in PDF

“This pro bono project is dedicated to all the student loan collectors that called and harassed me when I was just trying to get an education.” – Michael Fuller

Our Student Loan Client

On Think Out Loud

Ask an Oregon

Student Loan Lawyer

Unfortunately I get hundreds of messages each day and though I try, I’m not always able to personally respond to each of them. To speak with a leading national student loan law expert, you might try Joshua Cohen.

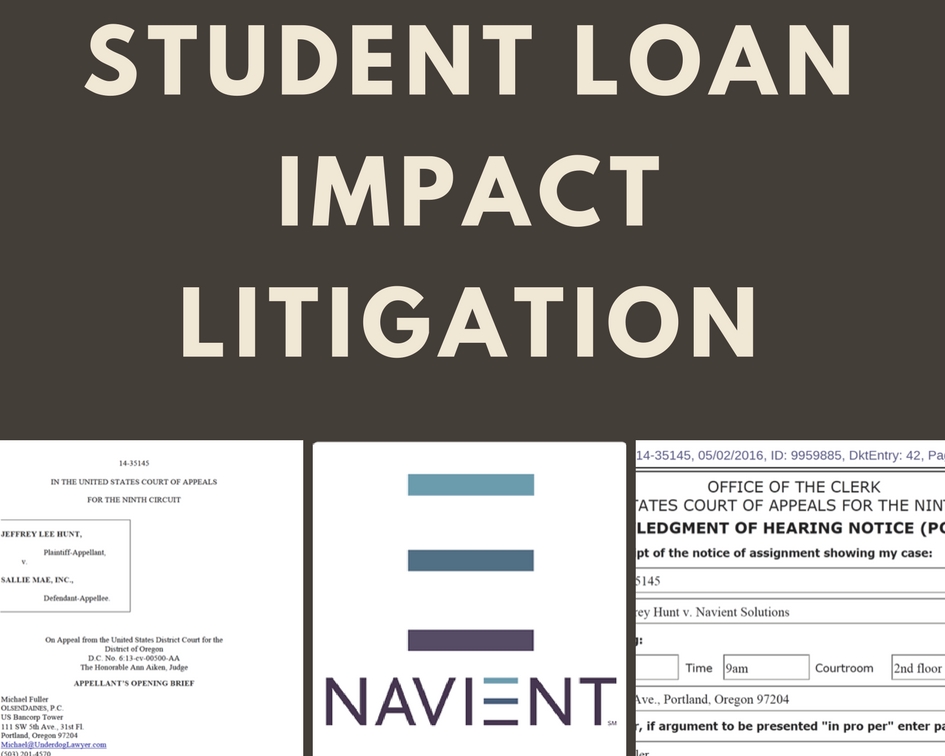

Sometimes we strategically take student loan cases we intend to argue on appeal. In 2015 we fought Navient in the Ninth Circuit Court of Appeals over student loan collector harassment.

Student Loan Lawsuit Defense

I defend student loan lawsuits at no cost for low income borrowers. The Multnomah Lawyer Magazine article below tells how our pro bono team beat Sallie Mae:

Click to increase article size

It’s illegal for student loan collectors to call you if they know you have an attorney. To stop calls, you can retain me as your attorney at no cost. The next time a collector calls, give them my name and number. They can’t call you again.

Trouble Making Student Loan Payments?

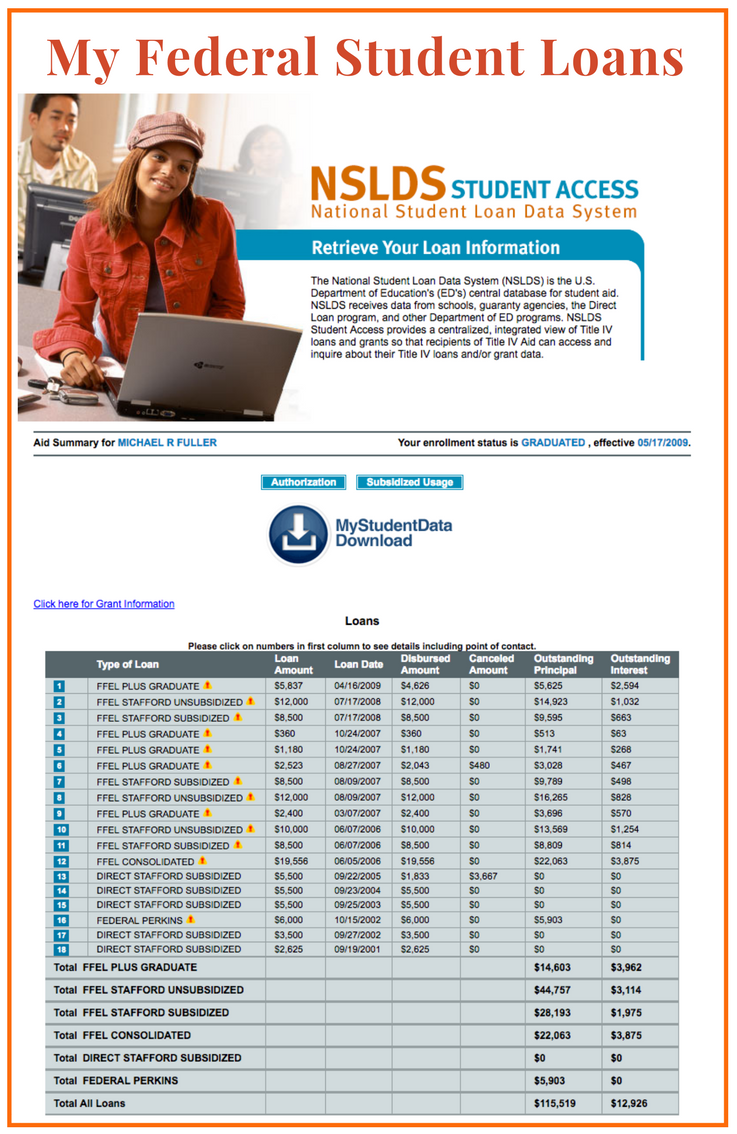

First, visit nslds.ed.gov to find all your federal student loans. These are my federal loans:

After graduation, I owed over $125,000 in federal loans. My federal loans went into default when the minimum payments got bigger than my paychecks.

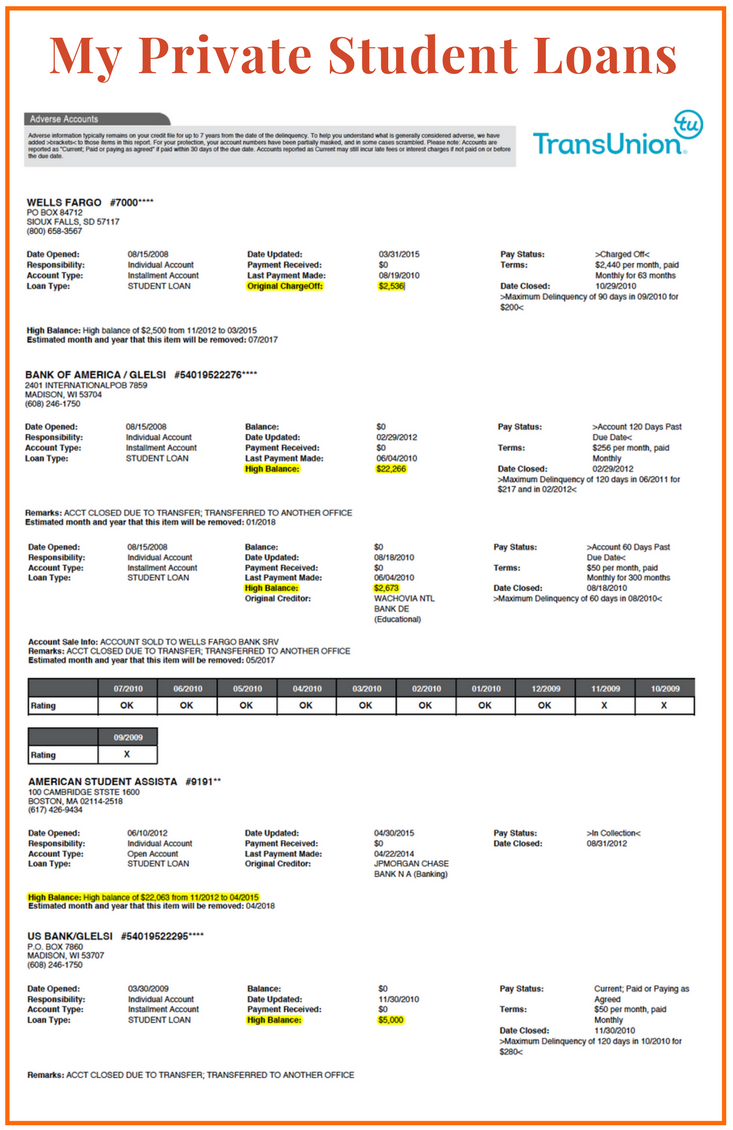

Next, visit annualcreditreport.com to find your private student loans. These are my private loans:

After graduation, I owed another $70,000 in private loans. Some private loans went to debt collectors. Others were charged off, and I never heard from them again. Some offered discounted settlements.

If you’ve read this far, maybe you’re in the same boat I was. If you are, I have good news. As I learned with my own student loans, these things have a way of working out. There are laws to protect you, and every student loan problem has a solution.

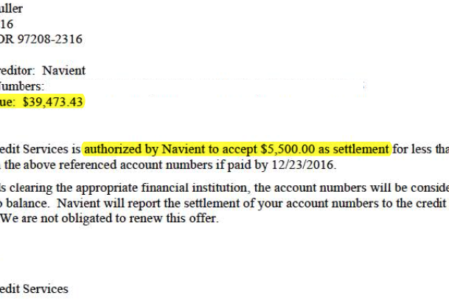

On a positive note, missing student loan payments sometimes brings in discounted settlement offers. I was able to pay off this $39,000 student debt to Navient for pennies on the dollar.

I’ve helped hundreds of Oregon families with student loan problems over the years. I’m happy to talk with you at no cost. You can rest easy, and stop worrying about your student loans.

Federal Student Loan Repayment

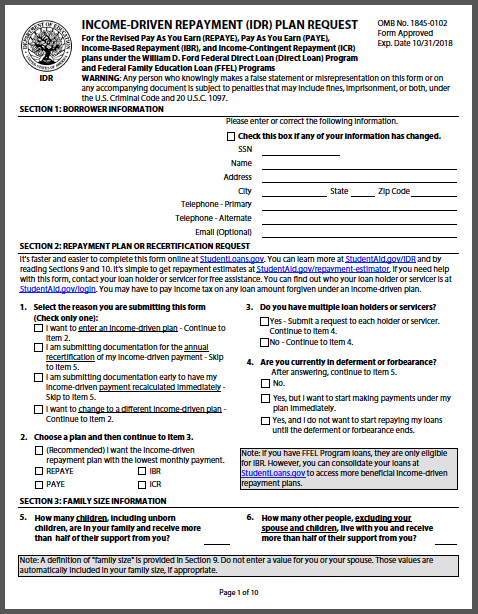

Your goal is to enter an income driven repayment plan for all your federal loans. Income driven means your monthly payment will be affordable. All your federal loans are forgiven after 20 to 25 years of repayment.

Click to download an income driven repayment plan request form

Repayment plans require your federal loans be in good standing. Defaulted loans can be “rehabilitated” into good standing. All you have to do is make 9 out of 10 monthly payments of $5 or more. You may want to strategically consolidate federal loans to get the best repayment plans possible.

If you’re thinking about paying an attorney for student loan advice, consider these types of questions:

- Rehabilitation. If my loans are in default, how do I get them out?

- Consolidation. What are the specific benefits of consolidation?

- Repayment. Which specific income driven plan is best for me?

- Amount. How much will I pay? Should I file joint tax returns?

- Forgiveness. What types of forgiveness do I qualify for?

- Taxes. Will I be taxed on forgiveness?

Federal Student Loan Forgiveness

If you can’t afford to repay your federal student loans, you may qualify to forgive them.

- Bankruptcy. Visit Oregon Student Debt to learn more about wiping out your student loans in bankruptcy.

- Death. When you die, your federal student loans die with you. Your co-signors, family, and heirs do not have to repay the debt.

- Public service. Teachers, government and nonprofit workers often qualify for federal student loan forgiveness.

- Income driven repayment. At the end of an income driven repayment plan, your remaining federal loan balance is forgiven.

- Disability. If you’re on VA or SSA disability, you can forgive your federal student loans. You may need a letter from your doctor if you’re not officially disabled.

- Closed school. Did your school close while you were a student? If you didn’t graduate, and your credits aren’t transferable, you may forgive your federal student loans.