Wells Fargo Fraud Victim Account Closure Scandal

If Wells Fargo improperly closed your account, submit a claim below:

Wells Fargo Fraud Victim Account Closure Scandal

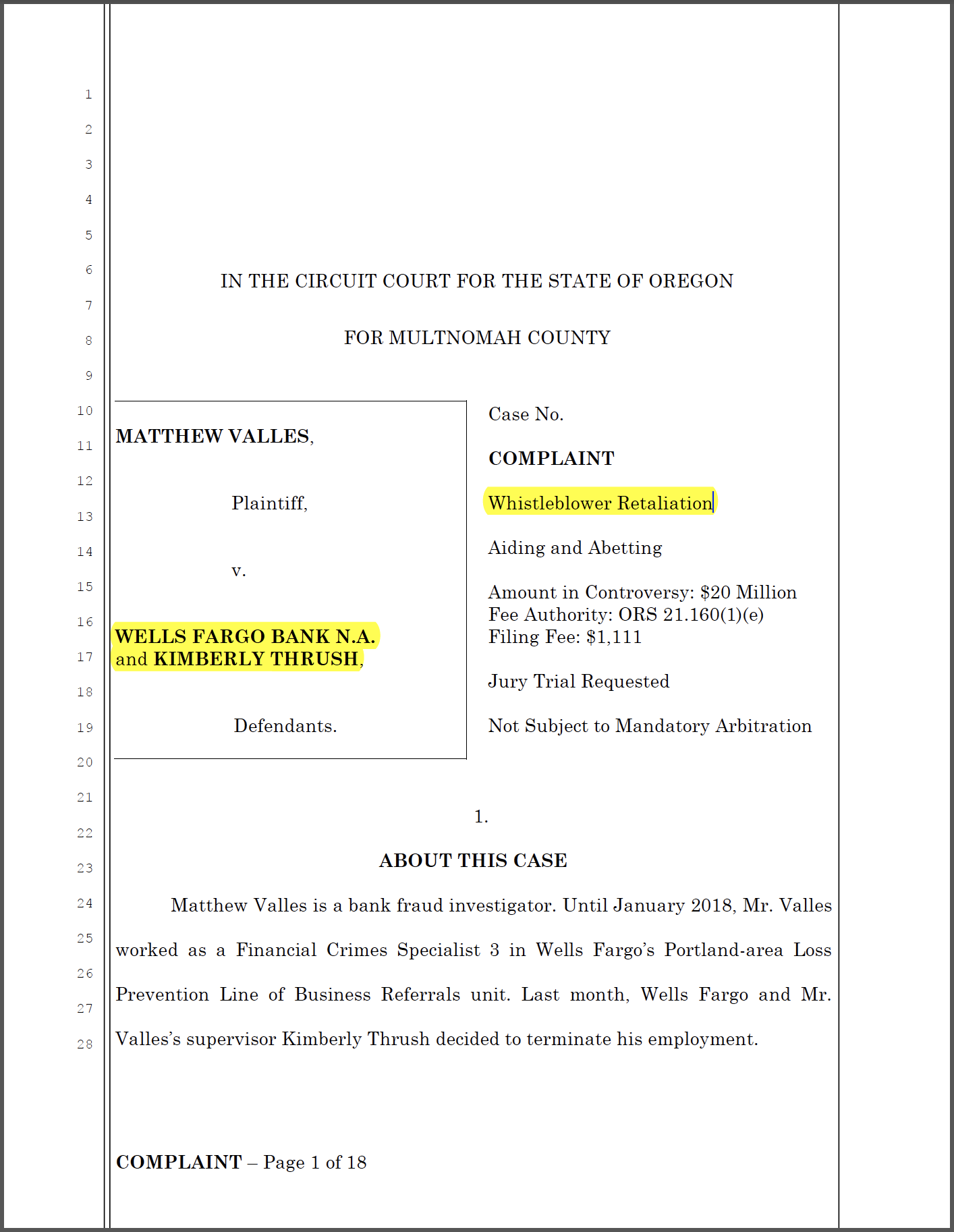

Matthew Valles is a bank fraud investigator. Until January 2018, Mr. Valles worked as a Financial Crimes Specialist 3 in Wells Fargo’s Portland-area Loss Prevention Line of Business Referrals unit. Last month, Wells Fargo and Mr. Valles’s supervisor Kimberley Thrush decided to terminate his employment. Read our filed complaint.

Prior to his termination, Mr. Valles had repeatedly complained to Wells Fargo management about what he believed was an illegal and systematic scheme to prematurely close certain customer accounts. Soon after transferring into the Loss Prevention Line of Business Referrals unit, Mr. Valles discovered that when Wells Fargo customers experienced fraud or unauthorized activity on an account, Wells Fargo failed to adequately investigate the fraud, and instead closed the account under the pretext of a “business decision”, leaving its customers to absorb the loss for any unauthorized withdrawals.

Wells Fargo customers have long complained that after being victimized by account fraud, their accounts were closed for no legitimate reason. Last year, federal authorities investigated accusations that Wells Fargo was wrongfully closing accounts subject to fraud. But until now, no proof existed to substantiate the accusations.

By filing his lawsuit, Mr. Valles became the first person to finally expose Wells Fargo’s fraud victim account closure scandal to the public.